Chip manufacturer Nvidia has become the first company in history to hit a $4 trillion dollar market capitalisation on Wall Street, after a rapid rise in value over recent months (). The Silicon Valley firm's share price rose 2.8% on Wednesday to $164.36, taking it past the previous record valuation held by Apple of $3.92T in December 2024.

The chip maker has bet big on the so-called AI revolution, and manufactures the vast majority of the chips powering the field's major companies like OpenAI. It also recently signed a bunch of multibillion deals in the Middle East, and has been a beneficiary of President Donald Trump rowing back on his threats of a trade war with China. The Financial Times describes Nvidia as "the biggest beneficiary of a tech boom that has exceeded the headiest days of the dotcom era," which might give some of us a little pause.

Nvidia still faces restrictions on selling its most powerful chips to China, but the company has been openly lobbying against it, with dire warnings that this will . But clearly shareholders think that, even with the uncertainty over China, there's enough global demand for Nvidia chips to keep the momentum going.

Analysts S&P Capital IQ project that Nvidia's revenue will come in at just under $200B this year, which would be up 55% year-on-year, with net income of $105B.

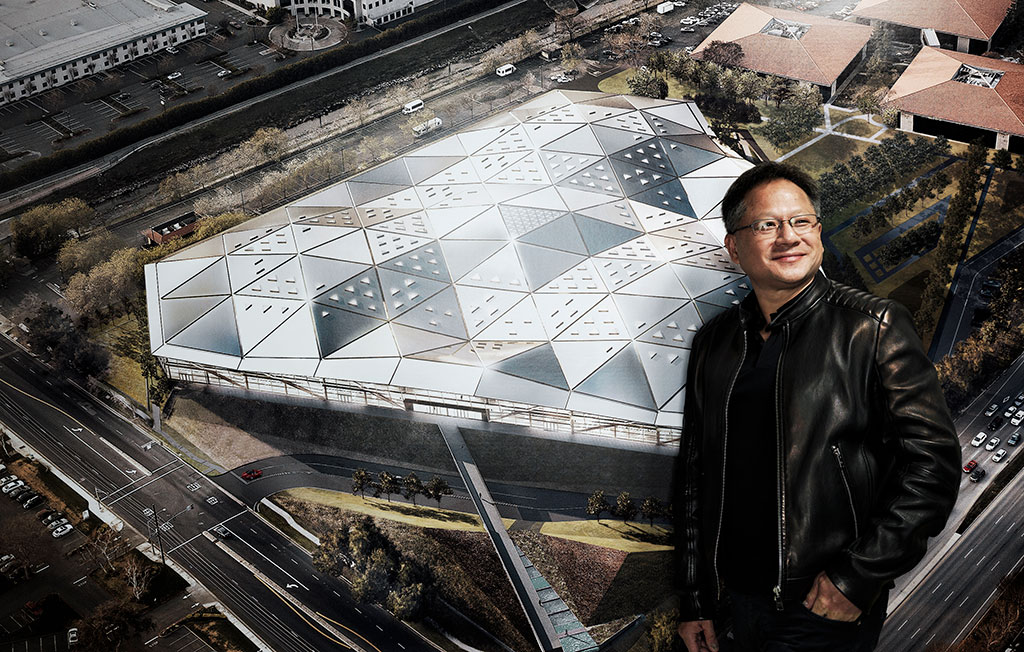

Good times for some, anyway: Nvidia's leadership including Huang sold $1B worth of shares in late June. Nvidia said at the time that Huang’s sales were part of a pre-arranged plan, and he retains the vast majority of his shares in Nvidia. Huang can sell up to six million shares before the end of 2025, which at the firm's current valuation would be worth just under a billion dollars. Not that he needs it: Forbes estimates Huang’s net worth at $138B, making him the 11th richest person in the world.

👉👈

1. Best overall:

2. Best value:

3. Best budget:

4. Best mid-range:

5. Best high-end: